How To Do Market Research For Supplement Products: A Complete Step Guide

.avif)

Launching a supplement brand isn’t just about finding a trendy formula or cool packaging. The market is crowded, regulations are strict, and customers are savvy. Without proper research, even the best-looking supplement can flop.

Knowing how to do market research for supplement products helps confirm that your idea can compete, sell consistently, and truly stand out.

This guide breaks down practical steps to analyze demand, spot opportunities, and avoid the common traps that new supplement sellers fall into.

7 Steps to Follow For Market Research For Supplement Products

Market research is easier when broken into clear steps. These steps give you a data-driven path to validate your idea before investing in production.Identify Market Demand First

1. Identify Market Demand First

Demand in the supplement world shifts quickly, with some ingredients gaining traction while others lose relevance. For example, collagen peptides have seen steady growth in recent years, while interest in raspberry ketones has dropped sharply.

To avoid chasing hype, validate demand with tools that provide real insight.

Key ways to measure demand:

- Use keyword research tools like Ahrefs, SEMrush, or Google Keyword Planner to find search volumes for terms like “ashwagandha supplements” or “protein powder.”

- Amazon Best Sellers rankings to see which supplement categories consistently sell at high volume.

- Google Trends to confirm whether interest is growing or declining for a particular ingredient.

For example, magnesium glycinate has gained momentum because buyers link it to sleep and relaxation, while demand for garcinia cambogia has collapsed. This difference shows where sustainable opportunity exists.

Ready to capitalize on market demand? If you're thinking of starting your own supplement brand, our private label supplement services make it easy to get started - with no minimum order requirements.

This means you can test high-demand products without committing to large inventory purchases upfront, letting you validate demand before scaling.

2. Analyze Competitors In Your Niche

Competition in supplements is unavoidable. Instead of being discouraged, study it. Competitor analysis shows where you can stand out.

Direct Competitor Research

Look at brands selling similar products. For instance, if you want to sell a magnesium supplement, search Amazon for “magnesium glycinate.” Review their:

- Pricing strategies

- Product descriptions and benefits highlighted

- Customer reviews (pay attention to complaints about brand packaging, dosage, or effectiveness)

Indirect Competitor Research

Identify broader brands that overlap with your niche. If you’re focusing on “sleep support,” you may not just compete with melatonin sellers; you’re also up against general wellness brands like Nature Made or NOW Foods.

Spot the Gaps

Customer reviews are brutally honest. Complaints about capsules being too large, poor taste in powders, or weak effects point to gaps you can fill, like offering gummies, smaller pills, or clinically backed dosages.

3. Understand Your Target Customer

Unlike general e-commerce, supplement buyers are health-driven and risk-averse. They’re skeptical of exaggerated claims and sensitive to trust signals.

Build a Customer Profile

Consider:

- Demographics: Age, gender, income. For example, collagen often targets women 25–45.

- Lifestyle: Fitness enthusiasts, professionals under stress, and older adults seeking joint health.

- Purchase drivers: Price sensitivity, eco-friendly packaging, organic sourcing.

Where To Gather Data

- Social media groups focused on fitness, nutrition, or wellness.

- Reddit forums like r/Supplements, where buyers share frustrations and product recommendations.

- Surveys and polls are sent through tools like Typeform to test interest.

Knowing who buys and why lets you craft marketing messages that resonate instead of shooting in the dark.

4. Evaluate Regulatory and Compliance Factors

Supplements have more red tape than other e-commerce categories. Market research isn’t complete without checking compliance requirements.

- The FDA (under DSHEA) prohibits claims like “cures depression” or “prevents cancer.” Violating this can get listings pulled or worse.

- Ingredients such as yohimbine, kava, or DMAA face restrictions or bans, and selling them could trigger account suspensions.

- International sales mean navigating EFSA in Europe, where even routine vitamins face tighter controls.

Failing to research regulations can lead to recalls, fines, or banned listings on platforms like Amazon.

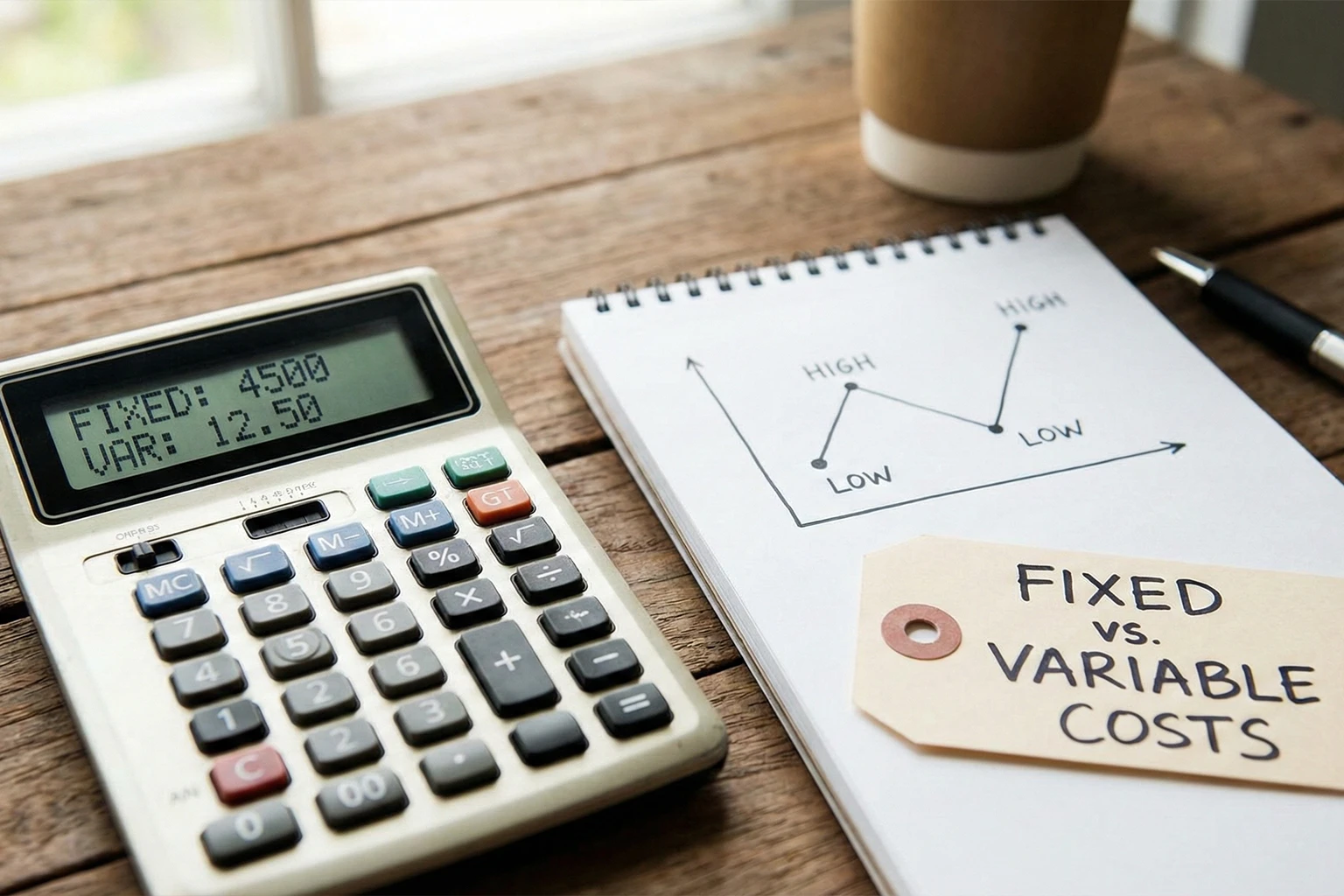

5. Study Pricing and Profit Margins

Supplements are attractive because of high perceived value, but costs add up fast.

Research Competitor Pricing

- Entry-level vitamins often retail between $10–20.

- Specialty formulas (e.g., adaptogen blends) can sell for $30–50+.

Factor In Costs

- Manufacturing and testing (especially if GMP-certified).

- Packaging and labeling that comply with regulations.

- Fulfillment fees if using Amazon FBA or a 3PL provider.

A $20 product with $12 in combined costs leaves slim room for profit once marketing spend is added. Market research should confirm whether your product can realistically achieve margins of 40–60% after expenses.

This is where an e-commerce profit calculator becomes helpful. It helps model all costs, from manufacturing to fulfillment, so you can confirm whether your pricing strategy supports healthy margins.

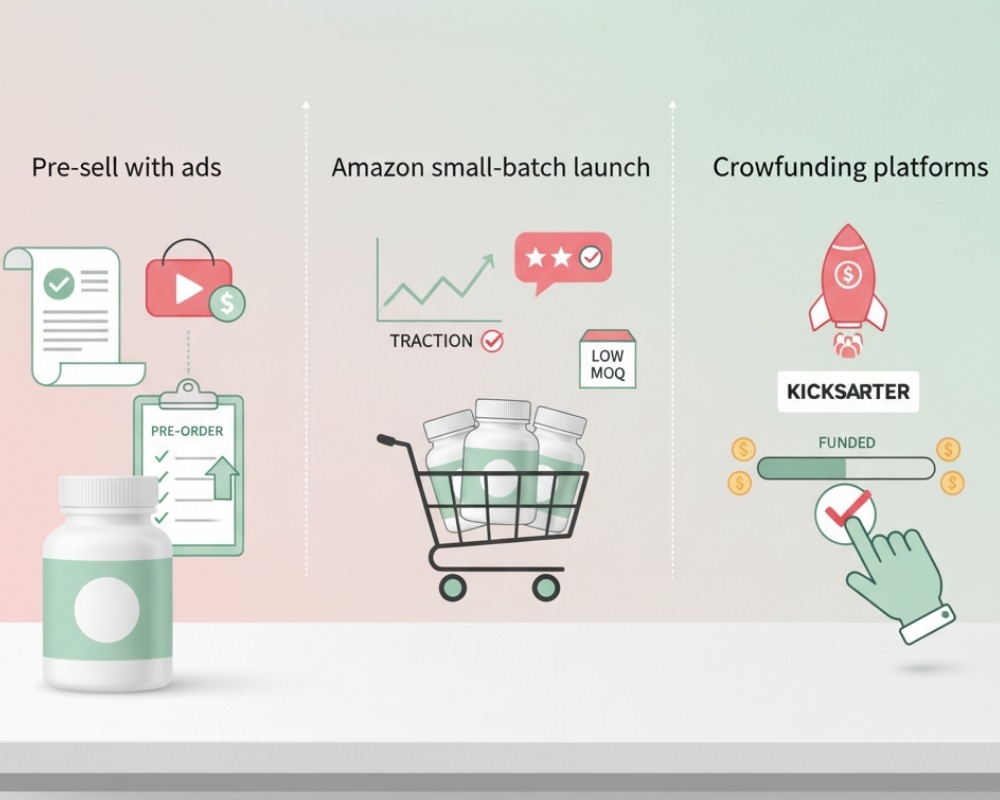

6. Use Real-World Testing Before Launch

Data and research tools provide a foundation, but testing confirms it. Small-scale validation prevents costly mistakes.

Methods To Test Demand

- Pre-sell with ads: Run Meta or TikTok ads driving to a landing page with a pre-order option. Track interest.

- Amazon small-batch launch: Start with a low MOQ (minimum order quantity) from a contract manufacturer to test reviews and traction.

- Crowdfunding platforms: Kickstarter and Indiegogo campaigns work well for new supplement blends.

This testing stage can reveal whether interest converts into sales before you commit to large production runs.

Avoid Common Market Research Mistakes

Plenty of new supplement sellers waste money and time by skipping critical checks. Watch out for:

- Chasing trends blindly: A surge in interest (like CBD in 2018) doesn’t guarantee long-term sustainability

- Ignoring compliance: Many brands launch products only to get suspended on Amazon for unapproved claims.

- Not testing margins: A “popular” product that eats your profits is not viable.

- Overlooking differentiation: Selling the same turmeric capsule as 100 other brands makes standing out nearly impossible.

Advanced Strategies To Deepen Your Research

Beyond the basics, advanced tactics sharpen supplement market insights. Social platforms like TikTok and Instagram often highlight new supplement formats, such as “sleep gummies” or “greens powders”, before they hit mass markets.

Tools like Jungle Scout, Helium 10, or SimilarWeb give a clearer picture of sales velocity and traffic trends.

Checking manufacturer capabilities early is also critical, since not all suppliers can deliver GMP or NSF standards.

Look at customer lifetime value: protein powders and probiotics typically drive repeat monthly orders, while niche products like detox teas may not. Use our customer lifetime value calculator to help quantify which categories deliver the strongest long-term revenue.

The Path Forward for Supplement Sellers

Market research for supplement products isn’t about collecting endless reports; it’s about gaining clarity before investing.

By verifying demand, analyzing competitors, defining your target customer, checking compliance, and testing on a small scale, you position your brand for growth instead of guesswork.

The supplement industry rewards sellers who do their homework. With solid research, the next step is simple: move forward confidently with product development, knowing your decisions are backed by real data and customer insight.

The information provided in this article is meant for general informational purposes only and should not be considered as professional or legal advice. We do not guarantee the completeness, accuracy, reliability, or suitability of the information in this article. We strongly recommend seeking professional guidance that suits your individual circumstances.

FAQ

Related blogs

High-Low Method Calculator: Discover Your True Fixed and Variable Costs

Influencer Pricing Calculator: Find Your Fair Rate for Posts, Reels & Stories

.avif)

.avif)