Chargeback ROI Calculator: Predict Your Savings and ROI in Under 10 Seconds

Every month, chargebacks quietly drain thousands of dollars from your ecommerce business. Between lost product costs, processing fees, and time spent managing disputes, these costs compound faster than most brand owners realize.

The Chargeback ROI Calculator helps you calculate exactly how much money you're losing to chargebacks each month and reveals potential savings from reducing your chargeback rate. Whether you're investing in fraud prevention tools or improving customer service, this calculator shows whether your prevention efforts deliver genuine ROI.

Why Chargeback Costs Matter More Than You Think

Most e-commerce business owners only see the surface-level pain of chargebacks. A customer disputes a charge, you lose the sale, and your payment processor hits you with a fee. But the real financial damage extends much deeper.

When you experience a chargeback, you're actually losing:

- The full product cost - Customer receives a refund while you've already paid for manufacturing and fulfillment

- Chargeback fees - Processors charge $15-$100 per dispute, regardless of outcome

- Shipping expenses - Delivery costs you've already incurred that can't be recovered

- Time and labor - Staff hours spent gathering evidence and responding to disputes

- Processor penalties - High chargeback rates trigger increased fees or account termination risk

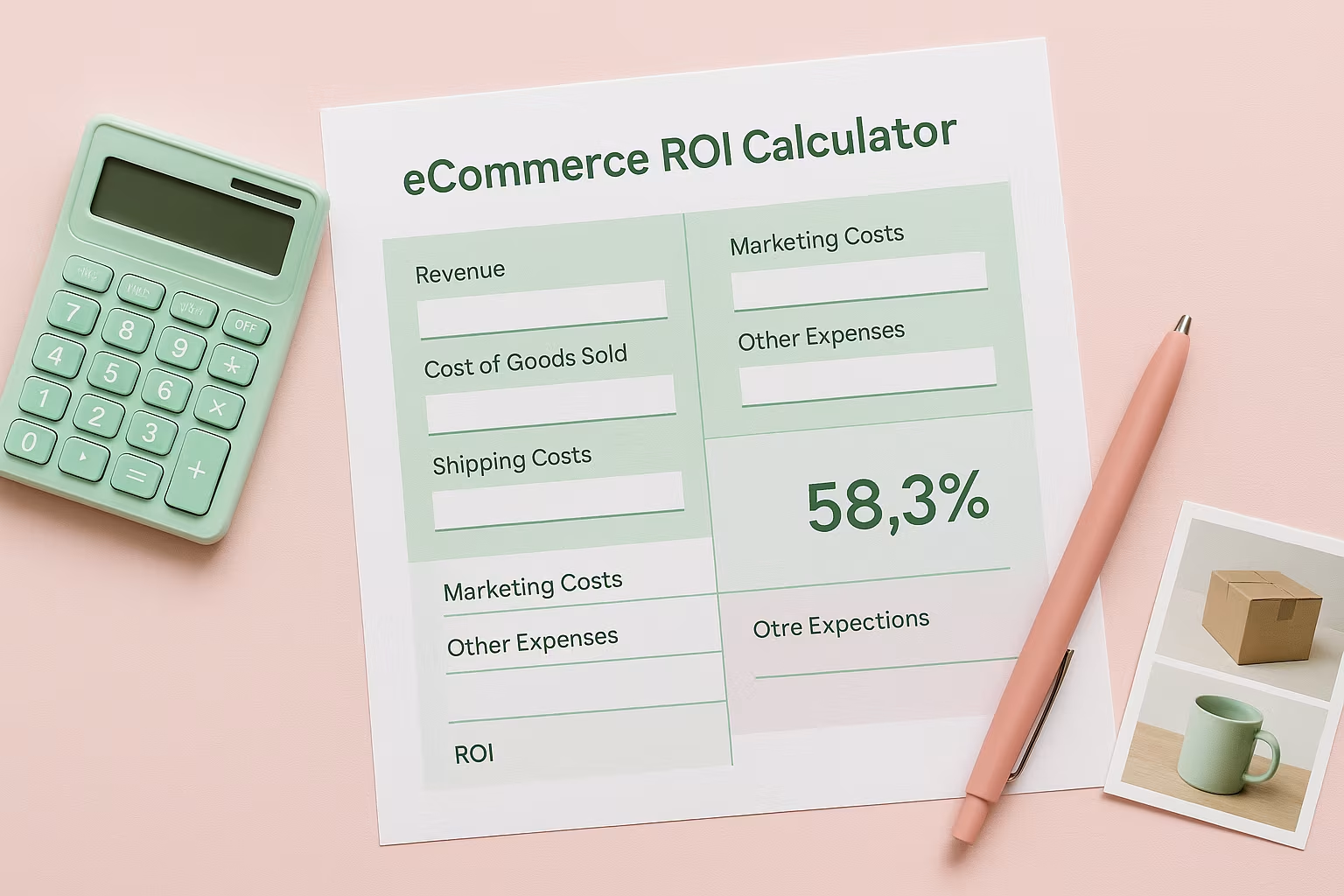

For brands using Shopify integration or selling through TikTok Shop, tracking these metrics becomes crucial when scaling across multiple channels. The calculator reveals:

- Current monthly losses from chargebacks

- Projected costs after implementing prevention measures

- Total monthly savings potential

- ROI percentage on your prevention investment

- Break-even point for your prevention spend

How to Calculate Your Chargeback ROI

Understanding your chargeback ROI requires tracking six key metrics. The calculator breaks down the math into straightforward steps that show exactly where your money goes.

Your baseline numbers:

- Monthly revenue - Total sales for the month

- Average order value - Typical customer purchase amount

- Current chargeback rate - Percentage of orders resulting in disputes

- Target chargeback rate - Your goal after implementing prevention strategies

- Cost per chargeback - What each dispute actually costs (product + fees + shipping + labor)

- Monthly prevention investment - Your spend on fraud tools, support improvements, or prevention strategies

The calculation process:

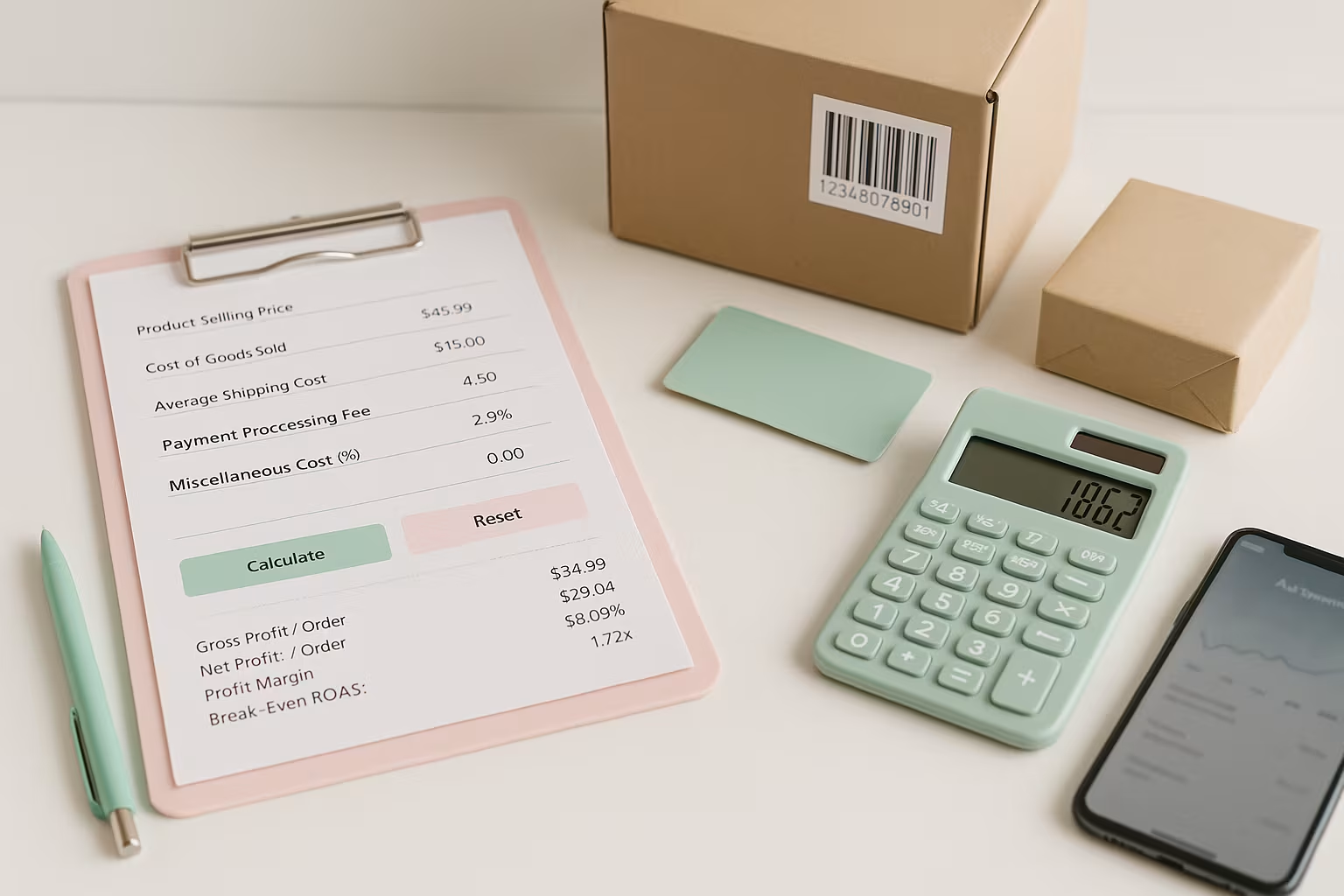

The calculator first determines your monthly order volume by dividing revenue by average order value. For example, $50,000 in monthly revenue with a $75 average order equals approximately 667 orders per month.

Current chargeback calculation: With a 1.5% chargeback rate, you're experiencing about 10 chargebacks monthly (667 orders × 1.5%). At $45 per chargeback (including all costs), that's $450 in monthly losses.

After the prevention calculation, reducing your rate to 0.5% drops chargebacks to roughly 3 per month. At the same $45 cost, projected losses fall to $150 monthly.

ROI analysis: Monthly savings of $300 ($450 - $150) against a $500 prevention investment results in a -$200 net benefit, or -40% ROI. This signals you need either lower prevention costs or better reduction results to break even.

This framework applies across business models:

- Private label supplements with subscription billing

- Coffee brands selling through multiple platforms

- Skincare lines with recurring orders

- Pet care products with wholesale accounts

Your target chargeback rate depends on your prevention strategy. Most businesses reduce chargebacks by 40-60% through better fraud detection, clearer product descriptions, and responsive customer service.

Common Strategies to Reduce Chargeback Rates

Reducing chargebacks doesn't require expensive enterprise software. Most successful strategies focus on improving customer experience and transparent communication.

Improve product descriptions:

The majority of chargebacks stem from "item not as described" disputes. Detailed product pages prevent this common issue:

- Multiple high-quality photos showing products from different angles

- Accurate specifications including size, weight, and ingredient details

- Clear usage instructions and realistic outcome expectations

- Authentic customer reviews provide social proof

- Transparent details about texture, scent, and sensory characteristics

For brands working with private label dropshipping, partnering with suppliers who provide comprehensive product information becomes essential. When launching your own supplement line, ensure your product pages match what customers actually receive.

Speed up fulfillment:

Slow shipping creates customer anxiety. When delivery takes too long, customers forget their purchases and dispute charges. Fast fulfillment prevents this:

- Send tracking numbers immediately after order placement

- Use carriers with detailed tracking capabilities

- Ship within 24-48 hours of order receipt

- Communicate expected delivery times upfront

- Proactively alert customers about any shipping delays

Brands using fulfillment services typically see lower chargeback rates because professional operations ship consistently and maintain quality standards.

Establish clear return policies:

Many customers file chargebacks simply because they don't understand your return process. Make returns straightforward:

- Display return policy prominently on every page

- Write policies in plain, accessible language

- Offer reasonable return windows (30-60 days is standard)

- Be transparent about return shipping costs

- Specify exact refund processing timeframes

Strengthen fraud detection:

Basic fraud detection catches obvious problematic patterns:

- Unusually large first orders from new customers

- Mismatched billing and shipping addresses

- Multiple orders to one address using different payment cards

- International orders shipping to high-risk regions

Most payment processors include built-in fraud tools worth enabling from day one.

Deliver fast customer service:

Quick responses prevent chargebacks. When customers can't reach support, they contact their bank instead:

- Offer live chat during standard business hours

- Set up email autoresponders acknowledging inquiries immediately

- Display clear contact information on every page

- Create FAQ pages addressing common concerns

- Follow up proactively after shipping to ensure satisfaction

For brands managing supplements, skincare, and pet care products, knowledgeable support staff resolve product questions before they escalate into disputes.

Using Calculator Results to Make Better Decisions

Raw numbers mean nothing without strategic action. Use your calculator results to guide concrete business improvements.

Start with low-cost, high-impact changes:

Focus first on improvements, delivering significant results without major investment:

- Enhance product descriptions with detailed photos and specifications

- Add comprehensive size guides and measurement charts

- Set up automated confirmation and shipping notification emails

- Create thorough FAQ pages addressing common customer concerns

- Train customer service teams to resolve issues before escalation

For brands working on label design and branding, ensure packaging accurately represents what customers see online to prevent "not as described" disputes.

Compare prevention scenarios:

Use the calculator to evaluate different strategic approaches:

- Scenario A: Accept 1.5% chargebacks with zero prevention investment

- Scenario B: Invest $200 monthly to reduce the rate to 0.5%

- Scenario C: Invest $500 monthly to achieve a 0.2% rate

The calculator reveals which scenarios deliver positive ROI based on your actual order volume and costs.

Track progress monthly:

Set realistic targets and measure actual results:

- Run calculations at the same time each month for consistency

- Document all prevention measures you implement

- Note which specific improvements drive results

- Adjust strategies based on performance data

For brands scaling through Shopify or TikTok Shop, consistent tracking shows how different sales channels affect your overall chargeback rate.

Calculate long-term financial impact:

Losing $500 monthly to chargebacks equals $6,000 annually. Over three to five years, these numbers justify prevention investments that initially appear expensive but deliver returns quickly through reduced losses.

For businesses planning to scale revenue or expand product lines, reducing chargeback rates before growth prevents problems from scaling proportionally with your business.

Turn Your Chargeback Data Into Profit-Boosting Decisions

Understanding what chargebacks truly cost your brand represents the first step toward fixing the leak in your revenue.

Now that you've calculated your projected savings and ROI, you can make confident, data-backed decisions that strengthen profit margins, reduce disputes, and unlock sustainable long-term growth.

Use these insights to refine your customer journey, tighten fulfillment operations, and invest strategically where the financial payoff justifies the expense.

If you're ready to scale with fewer disputes and smoother fulfillment, explore how Supliful can streamline your brand's operations through on-demand fulfillment, private label products, and professional support services that help you grow profitably.

FAQ

Related blogs

Price Elasticity Of Demand Calculator: Predict Revenue Impact in Seconds

Break-Even ROAS Calculator: Find Out What You Can Afford to Spend on Ads

Ecommerce ROI Calculator: Scale Your Store